iPhone, Services, Mac sales up, iPad and wearables down in fiscal first quarter

Apple has announced the financial results for its fiscal 2024 first quarter that ended December 30, 2023. The company posted quarterly revenue of $119.6 billion, up 2% year-over-year, and quarterly earnings per diluted share of $2.18, up 16% year-over-year.

“Today Apple is reporting revenue growth for the December quarter fueled by iPhone sales, and an all-time revenue record in Services,” said CEO Tim Cook. “We are pleased to announce that our installed base of active devices has now surpassed 2.2 billion, reaching an all-time high across all products and geographic segments. And as customers begin to experience the incredible Apple Vision Pro tomorrow, we are committed as ever to the pursuit of groundbreaking innovation — in line with our values and on behalf of our customers.”

“Our December quarter top-line performance combined with margin expansion drove an all-time record EPS of $2.18, up 16 percent from last year,” said Luca Maestri, Apple’s chief financial officer. “During the quarter, we generated nearly $40 billion of operating cash flow, and returned almost $27 billion to our shareholders. We are confident in our future, and continue to make significant investments across our business to support our long-term growth plans.”

As usual, the iPhone was the top earner. The Phone active installed base grew to a new all time high and Apple had an all time record number of iPhone upgraders during the quarter. Cook says that customers are loving the new iPhone 15 family with the latest reports from 451 Research indicating customer satisfaction of 99% in the US.

“In fact, many iPhone models were among the top-selling smartphones around the world during the quarter,” he says. “According to a survey from Cantar, iPhones were four out of the top five models in the US and Japan, four out of the top six models in urban China and the UK, and all top five models in Australia.”

Not surprisingly, Services revenue (Apple Music, Apple TV+, AppleCare, iCloud, etc.) set an all time record of $23.1 billion, up 11% year-over-year (taking into account the extra week last year.) This represents a sequential acceleration of growth from the September quarter.

“Our installed base is now over 2.2 billion active devices and continues to grow nicely establishing a solid foundation for the future expansion of our services business,” says Maestri. “And we continue to see increased customer engagement with our services; both transacting accounts and paid accounts reached a new all-time high… We had well over 1 billion paid subscriptions across the services on our platform, more than double the number that we had only four years ago

But it was also good news for the Mac, which generated revenue of US$7.8 billion. Maestri says customer response to the latest iMac and MacBook Pro models powered by the M3 chips has been “great.” He adds that the Mac installed base reached an all time high with almost half of Mac buyers during the quarter being new to the product. Also, 451 Research recently reported customer satisfaction of 97% for Mac in the US.

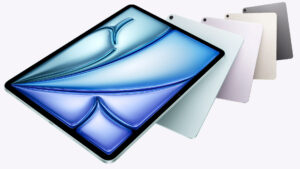

The news wasn’t as good for the iPad , whose revenue was $7 billion — down 25% year-over-year. Maestri says the tablet iPad faced a difficult compare because during the December quarter last year, Apple launched the new iPad Pro and iPad 10 generation and there was an extra week of sales.

“However, the iPad installed base continues to grow and is at an all time high with over half of the customers who purchased iPads during the quarter being new to the product,” he says. “Customer satisfaction for iPad was recently measured at 98% in the US.”

Apple’s wearables/home/accessories market (which includes the Apple Watch, AirPods, HomePods, etc.) was $12 billion, down 11% year-over-year due to a challenging compare and the extra week a year ago. But Cook says the company We continues to attract new customers to Apple Watch.

“Nearly two-thirds of customers purchasing an Apple watch during the quarter were new to the product,” he say. “And the latest reports from 451 research indicate customer satisfaction of 96% in the US and in services. We were very pleased with our double-digit growth, which was driven by the strength of our ecosystem.”

In terms of revenue, the iPhone accounted for 58.3% of Apple’s revenue in the fiscal first quarter of 2024. Services were 19.3%, Wearables/home/accessories was 105, the Mac was 6.5%, and the iPad 5.9%.

In a call with the press and investors, Cook said that Apple is investing a “tremendous” amount of time and effort in AI, with details to come later this year.

“As we look ahead, we will continue to invest in these and other technologies that will shape the future,” he said. “That includes artificial intelligence, where we continue to spend a tremendous amount of time and effort and we’re excited to share the details of our ongoing work in that space later this year.”

Apple’s board of directors has declared a cash dividend of $0.24 per share of the company’s common stock. The dividend is payable on February 15, 2024 to shareholders of record as of the close of business on February 12, 2024.

Based on the company’s fiscal calendar, Apple’s fiscal 2024 first quarter had 13 weeks, while its fiscal 2023 first quarter had 14 weeks.

The post iPhone, Services, Mac sales up, iPad and wearables down in fiscal first quarter appeared first on MacTech.com.