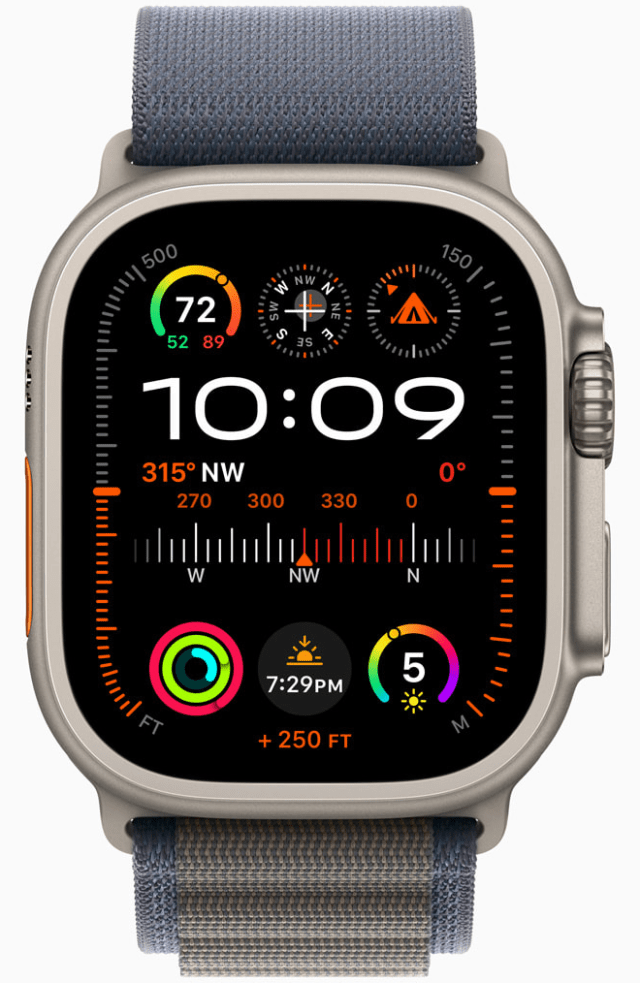

U.S. teens overwhelmingly want iPhone and Apple Watch vs. any other brands

U.S. teens overwhelmingly want to own Apple’s iPhone and Apple Watch versus any other smartphone and smartwatch brands.

Piper Sandler, a leading investment bank, has completed its 47th semi-annual “Taking Stock With Teens” survey in partnership with DECA. The Piper Sandler equity research team now has more than 61 million data points around U.S. teen preferences and spending in the 23 plus years of researching teens.

“We are excited to share the results of our spring 2024 Taking Stock With Teens® survey which offers an in-depth look at how Gen Z is impacting our overall economy through their spending habits. Our survey results indicate a slight increase in teen spending sequentially from fall 2023, but self-reported spend is down 6% year-over-year, well below pre-pandemic levels. We are seeing some significant shifts in brand preferences including the rise of smaller, innovative brands which are taking share from incumbents. We think social media has led to an accelerated trend cycle including an increased emphasis on key products, and brands will have to be nimble to keep up,” said Abbie Zvejnieks, senior research analyst at Piper Sandler, in a statement.

Malcolm Owen for AppleInsider:

For watch brands, upper-income teens have continued to rate Apple as their favorite once again. However, Apple’s 36% share is a drop from the 42% of the Fall 2023 and Spring 2023 surveys, and it’s only just ahead of its nearest rival, Rolex at 34%.

It is said that 34% of overall teens currently own an Apple Watch, which is flat versus last fall. The intent to buy an Apple Watch in the next six months did go up from 10% in the fall to 13%.

iPhone ownership is still at a record high of 85%, with an intent to purchase sitting at 86%. Piper Sandler writes that while the data remains positive, “the slight downturn is notable for near-term iPhone demand.”

When asked which music services they had used over the last six months, about 35% said Apple Music, which is relatively consistent with the last two surveys. Spotify managed about 65%, though in the fall it was at 70%.

On actual paid subscriptions for services, about 30% say they paid for Apple Music in the last six months, versus Spotify at nearer 45%.

For video, Apple TV+ ranks among the lowest when it comes to daily video consumption, with around 1% recorded by the survey. Youtube and Netflix both dominate with figures around 27%, though these are down from their highs of over 30% in previous years.

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

MacDailyNews Note: The Piper Sandler Taking Stock With Teens survey is a semi-annual research project that gathers input from 6,020 teens with an average age of 16.1 years. Discretionary spending patterns, fashion trends, technology, brand and media preferences are assessed through surveying a geographically diverse subset of high schools across the U.S. Since the project began in 2001, Piper Sandler has surveyed more than 254,303 teens and collected over 61 million data points on teen spending.

Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post U.S. teens overwhelmingly want iPhone and Apple Watch vs. any other brands appeared first on MacDailyNews.