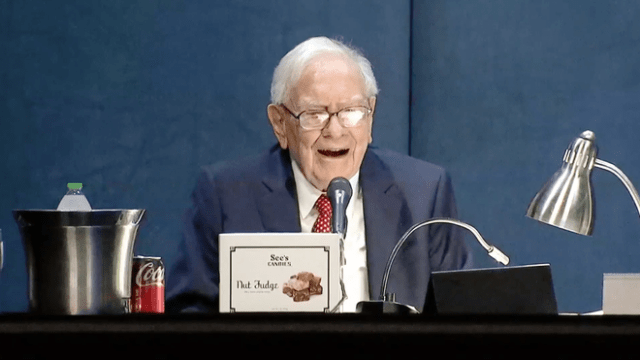

Warren Buffett heaps praise on Apple despite trimming stake in Q1

Berkshire Hathaway Chairman Warren Buffett on May 4, 2024

Berkshire Hathaway Chairman Warren Buffett heaped praise on Apple despite Berkshire trimming its position in the Mac maker in the first quarter.

Jonathan Stempel and Koh Gui Qing for Reuters:

Buffett, 93, told shareholders that Vice Chairmen Greg Abel and Ajit Jain have proven themselves the right people to lead Berkshire after he departs… The meeting, part of a weekend Buffett calls “Woodstock for Capitalists,” was the first since [longtime partner Charlie] Munger died in November at age 99. Buffett described Munger, his longtime his friend and foil, as the “architect of today’s Berkshire.”

Buffett gave no sign he plans to step aside, telling shareholders, “I feel fine,” while joking he shouldn’t take on four-year employment contracts.

In a surprise, Berkshire reported it had sold about 13% of its Apple shares, reducing the value of its stake to $135.4 billion from $174.3 billion. Apple’s stock price fell 11% in the quarter.

The sale was the main reason Berkshire’s cash hoard soared. Buffett said cash might grow to $200 billion this quarter, reflecting the risks he sees from high stock market valuations and geopolitical conflicts.

Despite reducing the Apple stake, Buffett praised the company, saying it was “an even better business” than two of Berkshire’s oldest and largest investments, American Express, and Coca-Cola.

The iPhone was “one of the greatest products, and it may be the greatest product, of all time,” Buffett said with Apple Chief Executive Tim Cook in the audience.

Berkshire invested in Apple in 2016, and the normally tech-phobic Buffett came to view it as a consumer goods company with strong pricing power and devoted customers.

While some investors have expressed concern that Apple comprised too much of Berkshire’s equity portfolio, Buffett said Apple would remain his company’s biggest stock investment, barring unforeseen events.

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

MacDailyNews Take: As for his Apple-heavy portfolio, as Buffet famously said many years ago, “Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post Warren Buffett heaps praise on Apple despite trimming stake in Q1 appeared first on MacDailyNews.