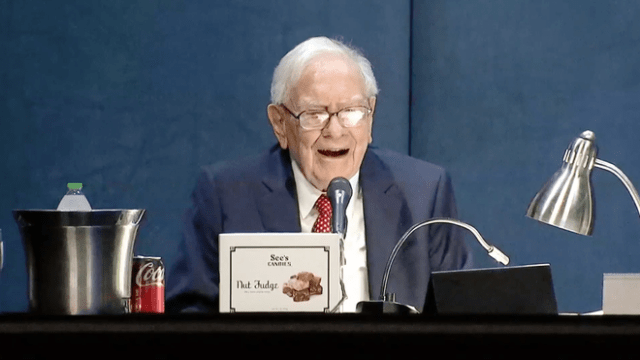

Berkshire Hathaway’s Warren Buffett understands Apple’s strong long-term value

Apple is Berkshire Hathaway’s largest holding, accounting for nearly 40% of its stock portfolio, because Warren Buffett understands Apple’s strong long-term value.

Stefon Walters for The Motley Fool:

Despite a lagging stock price, Apple’s long-term value remains strong.

An encouraging sign is Apple’s commitment to expanding its services and building an ecosystem that allows it to take advantage of the roughly 2 billion active iPhones worldwide… Between Apple Pay, Apple Card, Apple Pay Later, Apple Fitness+, and the many evolving health features on the Apple Watch, Apple has begun integrating itself more deeply into its users’ lives. This smart long-term move will help keep customers in the Apple ecosystem for the long haul.

Apple became the tech giant we know today because of its innovative hardware products, but the next phase of the company’s growth will rely on how it leverages this hardware to cement itself in different service industries. When you begin judging Apple that way, its long-term value becomes much more promising.

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

MacDailyNews Take: Apple Services have a gross margin of 74% (vs. 36% for products; still a strong number). With Apple’s installed base of active devices currently in excess of 2.2 billion and counting, barring a black swan the size of Godzilla, Apple’s long-term value is virtually unassailable, as Buffet clearly understands.

Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post Berkshire Hathaway’s Warren Buffett understands Apple’s strong long-term value appeared first on MacDailyNews.