Apple shuts Apple Pay Later, but it will return (sorta)

Apple has closed down its Apple Pay Later service, the BNPL service it launched last year in the US but plans to introduce a similar service in additional markets later.

Apple is returning to BNPL, in a way

In a statement provided to 9to5Mac, the company said it will introduce a payment system later this year which will be available globally, through credit and debit cards, when checking out with Apple Pay.

Announced in 2022 and launched in March 2023, the service let users borrow up to $1,000 and repay that amount over time. People who already have an Apple Pay Later arrangement will continue to hold that account for loan repayments.

What Apple said

“Our focus continues to be on providing our users with access to easy, secure and private payment options with Apple Pay, and this solution will enable us to bring flexible payments to more users, in more places across the globe, in collaboration with Apple Pay enabled banks and lenders,” that 9to5Mac statement said.

At WWDC the company also said

The decision was flagged at WWDC, when Apple said:

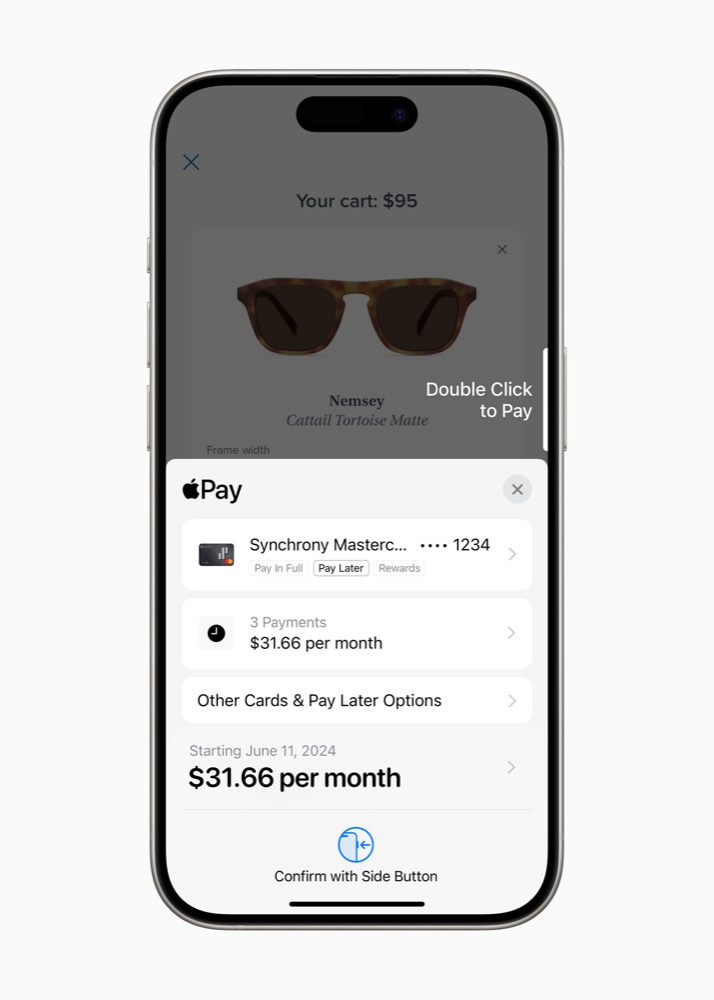

“Apple Pay introduces even more flexibility and choice for users when they check out online and in-app. Users can view and redeem rewards, and access instalment loan offerings from eligible credit or debit cards, when making a purchase online or in-app with iPhone and iPad.1 These features will be available for any Apple Pay-enabled bank or issuer to integrate in supported markets.

“The ability to redeem rewards for a purchase with Apple Pay will be available beginning in the U.S. with Discover and Synchrony, and across Apple Pay issuers with Fiserv. The ability to access instalments from credit and debit cards with Apple Pay will roll out starting in Australia with ANZ; in Spain with CaixaBank; in the U.K. with HSBC and Monzo; and in the U.S. with Citi, Synchrony, and issuers with Fiserv. Users in the U.S. will also be able to apply for loans directly through Affirm when they check out with Apple Pay.”

A little history repeating?

Apple had originally begun Apple Pay Later in a loose association with Goldman Sachs, but given that relationship seems to be tottering, it is perhaps no surprise the company is seeking partners who can deliver global reach. At the same time, Apple likely enjoyed a lot of success with the service over the 2023 holiday season, when Buy Now Pay Later (BNPL) sales hit all-time high.

The company also quickly achieved mind share with its service, according to GlobalData, which claimed the company led the conversation with its BNPL service following its launch. What isn’t quite clear yet – though it is probable – is the extent to which the new purported service will make use of Apple’s own financial risk tech, acquired with Credit Kudos.

Please follow me on Mastodon, or join me in the AppleHolic’s bar & grill and Apple Discussions groups on MeWe.