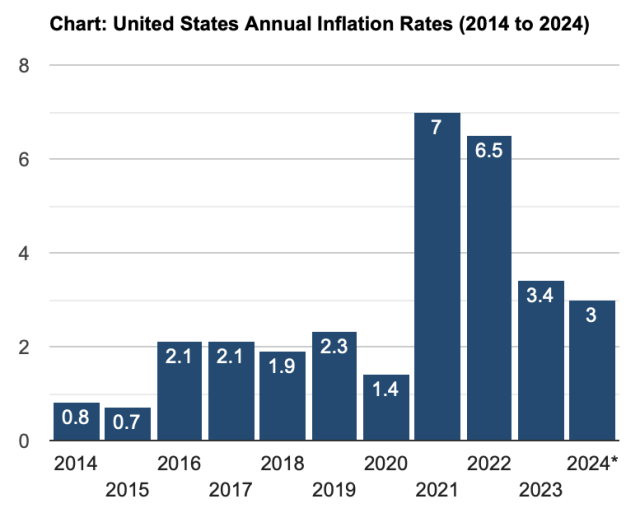

S&P 500 falls from record as investors rotate out of 2024 tech winners

(Source: U.S. Inflation Calculator)

*The latest inflation data (12-month based) is displayed in the chart’s final column

Wall Street took a turn on Thursday as investors shifted their focus. The S&P 500 pulled back from its record high after a slightly lower than expected U.S. inflation report. With interest rates expected to stay low, investors sold tech giants like Apple, Nvidia, Microsoft, and Meta and sought opportunities in small caps and the housing market.

Brian Evans and Lisa Kailai Han for CNBC:

The S&P 500 fell 0.8%, retreating from a record it touched earlier in the session. The Nasdaq Composite pulled back 1.8%, after also hitting a new record earlier in the trading day. The Dow Jones Industrial Average hovered near the flatline. Nvidia, which is up 165% on the year, lost nearly 4%.

The small-cap benchmark Russell 2000 Index gained 3% as investors hoped for a Federal Reserve rate cut in September and an economic soft landing following the inflation data.

Housing-related shares such as Home Depot and D.R. Horton jumped on the hope lower rates would reignite a stalling housing market. Industrial stocks such as Caterpillar also gained.

The consumer price index fell 0.1% last month from May, bringing the annual inflation rate down to 3%. Economists surveyed by Dow Jones had expected a 0.1% monthly increase and a 3.1% annual rate. Core CPI, which excludes food and energy, came in at a 3.3% annual rate, also lower than economists expected.

Treasury yields fell following the CPI data as traders upped their bets for interest rate cuts.

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

MacDailyNews Take: Unfortunately, it’s unlikely that prices will ever return to 2020 pre-inflation levels entirely, even if the CPI (Consumer Price Index) keeps decreasing. Here’s why:

• Generally rising price trend: Over long periods, inflation causes a gradual upward trend in prices. Even with a decrease in CPI, it usually means prices are rising at a slower rate, not actually falling back.

• Sticky prices: Businesses are often hesitant to lower prices once they’ve been raised as such moves can be seen as a sign of weakness or a reason for future discounts.

• Increased production costs: Even if inflation slows, underlying costs like wages and materials may not decrease significantly. Companies are likely to maintain higher prices to cover these costs.

Prices of certain goods, especially those with volatile demand or easily replaceable components, might return to pre-inflation levels if there’s a surplus or competition drives down costs.

Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post S&P 500 falls from record as investors rotate out of 2024 tech winners appeared first on MacDailyNews.