Warren Buffett’s Berkshire Hathaway closes above $1 trillion market value

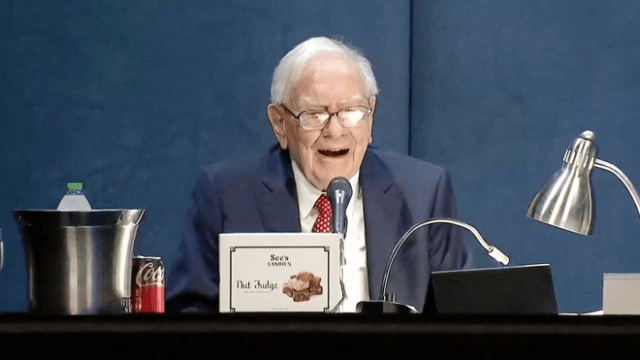

Berkshire Hathaway, the investment conglomerate headed by Warren Buffett, achieved a significant milestone on Wednesday. Its market value surpassed $1 trillion for the first time, underscoring investor confidence in the company’s ability to represent the broader American economy. Buffett has meticulously built Berkshire Hathaway over nearly six decades, transforming it into a widely recognized barometer of the U.S. market.

Jonathan Stempel for Reuters:

Buffett’s company joined six other U.S. companies, all in or tied to the technology sector, valued at more than $1 trillion: Apple, Nvidia, Microsoft, Google parent Alphabet, Amazon.com, and Facebook parent Meta Platforms.

Berkshire’s Class A shares closed up 0.7% at $696,502.02. The more widely held Class B shares rose 0.9% to $464.59.

Buffett, who turns 94 on Friday, has run Omaha, Nebraska-based Berkshire since 1965… Since the year Buffett took charge, Berkshire shares have gained more than 5,600,000%.

MacDailyNews Take: Congrats to Warren Buffett and Berkshire Hathaway. Would that Charlie Munger were here to see it (but, he likely knew the milestone valuation was coming soon).

MacDailyNews Note: Owning 400 million Apple shares, Berkshire Hathaway is the fourth largest Apple shareholder, following only the Vanguard Group with 1.27 billion shares representing 8.27% of total shares, BlackRock with 1.029 billion shares, representing 6.66% of total shares, and State Street Corporation with 528,075,179 shares.

Please help support MacDailyNews — and enjoy subscriber-only articles, comments, chat, and more — by subscribing to our Substack: macdailynews.substack.com. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post Warren Buffett’s Berkshire Hathaway closes above $1 trillion market value appeared first on MacDailyNews.