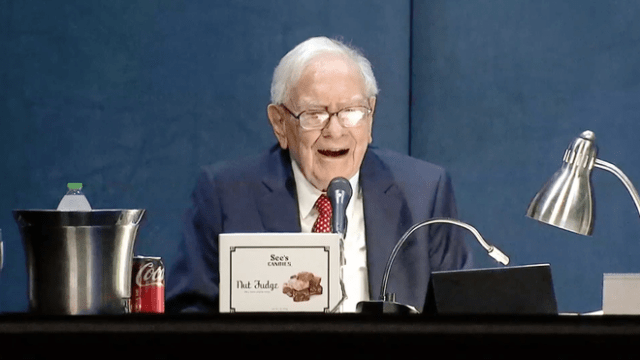

Oops! Warren Buffett left $23 billion on table by trimming Berkshire’s Apple stake

Warren Buffett’s investment firm, Berkshire Hathaway, substantially reduced its stake in Apple during the first half of 2024. According to regulatory filings, Berkshire has cut its Apple holdings by 55%. This move could have potentially cost the company a significant amount of money, as Apple’s stock price has risen by 10% since the end of the second quarter.

If Berkshire had maintained its previous position in Apple, its stake would be valued at approximately $210 billion at current market prices. This suggests that the company may have missed out on a $23 billion profit opportunity by trimming its Apple holdings.

Matthew Fox for Business Insider:

Calculations by Business Insider suggest Berkshire Hathaway’s sales of Apple stock in the first and second quarters of this year resulted in about $23 billion in missed profits for Warren Buffett’s conglomerate.

Berkshire Hathaway entered 2024 with a massive stake in Apple, holding 905.6 million shares worth about $174 billion at the time.

At current prices, that stake would have been worth about $210 billion. Instead, Berkshire Hathaway’s current stake in Apple was worth $84 billion at the end of the second quarter.

The difference between the weighted average price and the price of Apple stock on Thursday nets out the $23.1 billion in missed profits for Berkshire Hathaway.

MacDailyNews Take: $23 billion is quite the “oops!” And, that’s not even counting lost dividends! But, hey, nobody’s perfect. Own it, don’t trade it, Warren!

Please help support MacDailyNews — and enjoy subscriber-only articles, comments, chat, and more — by subscribing to our Substack: macdailynews.substack.com. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post Oops! Warren Buffett left $23 billion on table by trimming Berkshire’s Apple stake appeared first on MacDailyNews.