Berkshire Hathaway’s tax bill on 2024 Apple stock sales: $20 billion

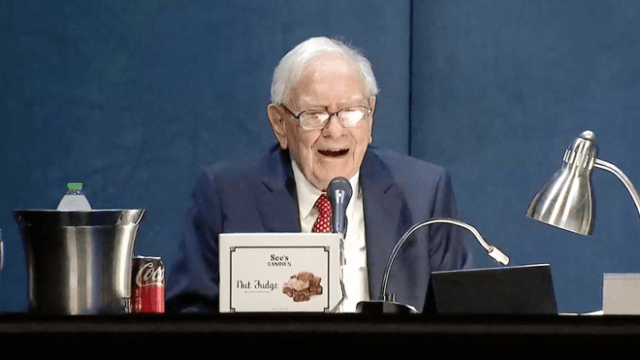

Berkshire Hathaway’s significant reduction in its Apple holdings is expected to result in a hefty tax bill. After selling over 600 million shares of Apple stock in the first nine months of 2024, including 100 million shares in the third quarter alone, Berkshire Hathaway is poised to be one of the largest corporate taxpayers this year. This strategic move by Warren Buffett’s company has sparked interest and speculation about the future of its investment portfolio.

In its 10-Q report released Saturday in tandem with its financial results, Berkshire disclosed that it sold another 100 million shares of Apple in the third quarter, reducing its stake by 25% in the period to 300 million shares. CEO Warren Buffett’s company has sold more than 600 million of the iPhone maker’s shares in the first nine months of 2024.

Barron’s estimates that Berkshire could owe more than $20 billion of taxes on the sales of Apple stock, which likely accounted for nearly all of the $97 billion of taxable gains on equity sales that Berkshire generated in the first three quarters of 2024.

We’re estimating the tax bill using a tax rate of about 25% based on the federal rate of 21% and Nebraska’s 5% corporate tax rate.

Berkshire doesn’t disclose what price it received for the Apple stock, but Barron’s estimates the average price at about $190 per share, with most of the shares sold in the second quarter. Apple shares gained 0.7% to $223.45 Tuesday.

MacDailyNews Take: Ouch! The good news is that after Berkshire sends its $20 billion to the feds, if one of the largest corporate tax payments this year is applied to the U.S. Federal debt of $35,974.270 trillion, America’s debt would all the way down to just $35,974.250 trillion!

Please help support MacDailyNews — and enjoy subscriber-only articles, comments, chat, and more — by subscribing to our Substack: macdailynews.substack.com. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post Berkshire Hathaway’s tax bill on 2024 Apple stock sales: $20 billion appeared first on MacDailyNews.