Warren Buffett’s Berkshire Hathaway sells $23 billion in Apple shares in Q3

Warren Buffett’s Berkshire Hathaway again significantly reduced its holdings in Apple in the third quarter of 2024. The investment firm sold 100 million shares of Apple stock, amounting to a $23 billion divestment. This follows an earlier sale of over 500 million shares, totaling $94 billion.

GuruFocus:

In addition to trimming its Apple holdings, Berkshire also reduced its position in Bank of America, divesting 23% of its stake for $10 billion and securing a $6 billion profit. Nevertheless, Berkshire still owns about 10% of the bank, and shareholders approved the reduction.

On the acquisition side, Berkshire made strategic moves, adding new positions in Domino’s Pizza with a $605 million purchase of 1.3 million shares, and Pool Corporation with $140 million worth of shares.

As of September 2024, Berkshire’s total equity investments amounted to $266.4 billion, reflecting a 4.9% decrease compared to the previous quarter.

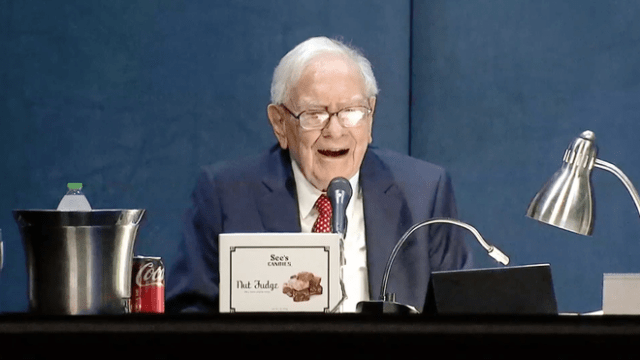

MacDailyNews Take: In May, at Berkshire’s annual meeting, Buffett praised Apple, saying it was “extremely likely” that Apple will remain Berkshire’s largest holding at the end of 2024. Berkshire continues to hold $69.9 billion worth of Apple shares.

Please help support MacDailyNews — and enjoy subscriber-only articles, comments, chat, and more — by subscribing to our Substack: macdailynews.substack.com. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post Warren Buffett’s Berkshire Hathaway sells $23 billion in Apple shares in Q3 appeared first on MacDailyNews.