India plans iPhone tariff cut to boost manufacturing – report

Local reports claim Apple in India is already generating millions at its stores.

Apple in India is the real Apple Intelligence. Now the nation is about to spend billions to tempt Cupertino to put more manufacturing in place there as the war for the future of consumer manufacturing intensifies.

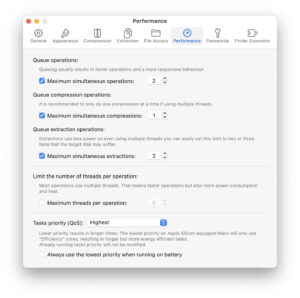

Cutting iPhone manufacturing costs

India is considering putting fresh subsidies in place to promote component manufacturing in India. It is also looking to cut import tariffs to support local manufacturing, particularly of high-end smartphones (read, iPhone).

Apple stands to benefit as India preps itself to pour around $2.7 billion in additional subsidies, with batteries and camera components of particular interest. These plans haven’t yet been approved, of course, but they are in the pipeline with news on the decision expected during the week.

This is just the latest big state intervention in India as the government seeks to build the nation into a powerhouse for consumer electronics manufacturing. India has spent tens of billions in incentives to lure companies there, with Apple at the forefront of this charge.

Why these costs matter

One stumbling block to these plans has traditionally been the cost of components made outside of India – some smartphone components, for example. India’s high import tariffs on these parts have acted as a brake on the momentum behind manufacturing deployment in India, and some of those tariffs now seem likely to be removed. Tariffs on those parts are much higher than those imposed elsewhere, including China and Malaysia.

One hundred year journey

Apple and its manufacturing partners are, meanwhile, making highly structured and targeted investments in India and elsewhere as they seek to build a resilient manufacturing ecosystem for the decades to come. India’s government seems more than willing to become the manufacturing ‘plus one’ to China, and while the future is hard to see, the facts are that by reducing tariff-driven costs on certain key components Apple is gradually reducing the cost of making iPhones in India, enabling it to continue to deliver aspirational devices in an increasingly difficult to achieve premium market.

You can follow me on social media! Join me on BlueSky, LinkedIn, Mastodon, and MeWe.