Apple sold one in every four smartphones sold in Q4

This one also runs Apple Intelligence…

Apple, Samsung, and now Xiaomi continue to enjoy growth at the expense of smaller players in the smartphone market, which saw a combined 3% year-on-year growth in Q4 2024. However, looking back growth, while welcome, seems a little slower than in similar quarters suggesting Apple’s AI smartphones haven’t quite generated too much heat yet.

Then again, those AI services aren’t yet universally available, so Apple has bought itself some time with the release of Apple Intelligence, and its focus on privacy and security will only become more important as consumers come to terms with the risks of unconstrained AI deployment.

Big and little, everything all at once

The latest numbers from Canalys echo sentiment from IDC, they tell us global smartphone shipments totaled 1.22 billion units across the year, reflecting a 7% year-on-year increase. Apple maintained its lead over Samsung for the second consecutive year.

Global smartphone sales grew by 3% to reach 330 million units in Q4 2024, the fifth consecutive quarter of growth. However, the growth rate has significantly slowed.

Highlights:

Apple took the top spot with a 23% market share.

Samsung followed with a 16% market share, experiencing a decline.

Xiaomi maintained its third position with a 13% market share, being the only brand to achieve year-on-year growth among the top three, driven by increasing presence in its home market and globalization efforts.

TRANSSION and vivo ranked fourth and fifth respectively, benefiting from the recovery of emerging markets in the Asia-Pacific region.

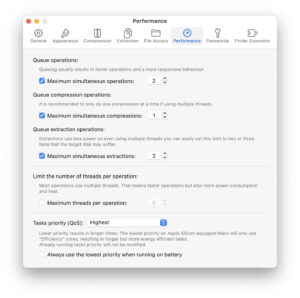

Screenshot

What Canalys said

“Apple solidified its global position through growth in emerging markets like India and Southeast Asia in 2024,” stated Canalys Analyst Le Xuan Chiew. “By expanding channel coverage and influence in the Asia-Pacific region, and leveraging active marketing and branding strategies, Apple captured growth opportunities. However, competition and a prolonged replacement cycle limited its growth momentum in some developed markets. Looking ahead to 2025, Apple is expected to achieve growth, driven by a refreshed portfolio, hardware upgrades and broader adoption of Apple Intelligence.”

What IDC saw

IDC saw similar sentiments. They claim global smartphone shipments increased 2.4% year-over-year (YoY) to 331.7 million units in the quarter and 1.24 billion shipments in the year. They also peg Apple at 23.2% market share but see this as a decline.

They also hint that consumers are ripe for a foldable smartphone that delivers at the high end (though arguably Samsung’s Fold almost does that), saying “Vendors have started shifting R&D away from foldables as consumer interest remains flat. Moreover, numerous vendors are prioritizing new AI advancements at the expense of foldables as AI is increasingly featured on more devices, particularly at the market’s upper echelon thanks to GenAI.”

We should wait and see if growth returns, however with consumers grappling with everything from food and energy price increases to the impact of AI on employment, even while their nativist governments march them into meaningless conflicts rather than easing their plight, it’s arguable that expectations of such growth may yet prove misplaced.

You can follow me on social media! Join me on BlueSky, LinkedIn, Mastodon, and MeWe.