Cord-cutting sports fans might soon have a savior: Gamblers

[ad_1]

With cable TV, the people who watch sports have always benefitted from those who don’t.

Even if you don’t care about local baseball or Monday Night Football, you still pay for that coverage as part of a big TV bundle. That in turn subsidizes the cost for the actual fans, who might otherwise to pay a lot more if sports channels were sold separately.

That delicate balance is becoming untenable. As the cost of live sports continues to increase, more cord-cutters are abandoning pay TV bundles in favor of services such as Netflix and Disney+, which offer better non-sports programming for less. That’s led to even more price hikes for pay TV, and higher bills for diehard sports fans. In many markets, watching local baseball or hockey teams without cable now costs at least $85 per month, and prices can be even higher with cable or satellite TV.

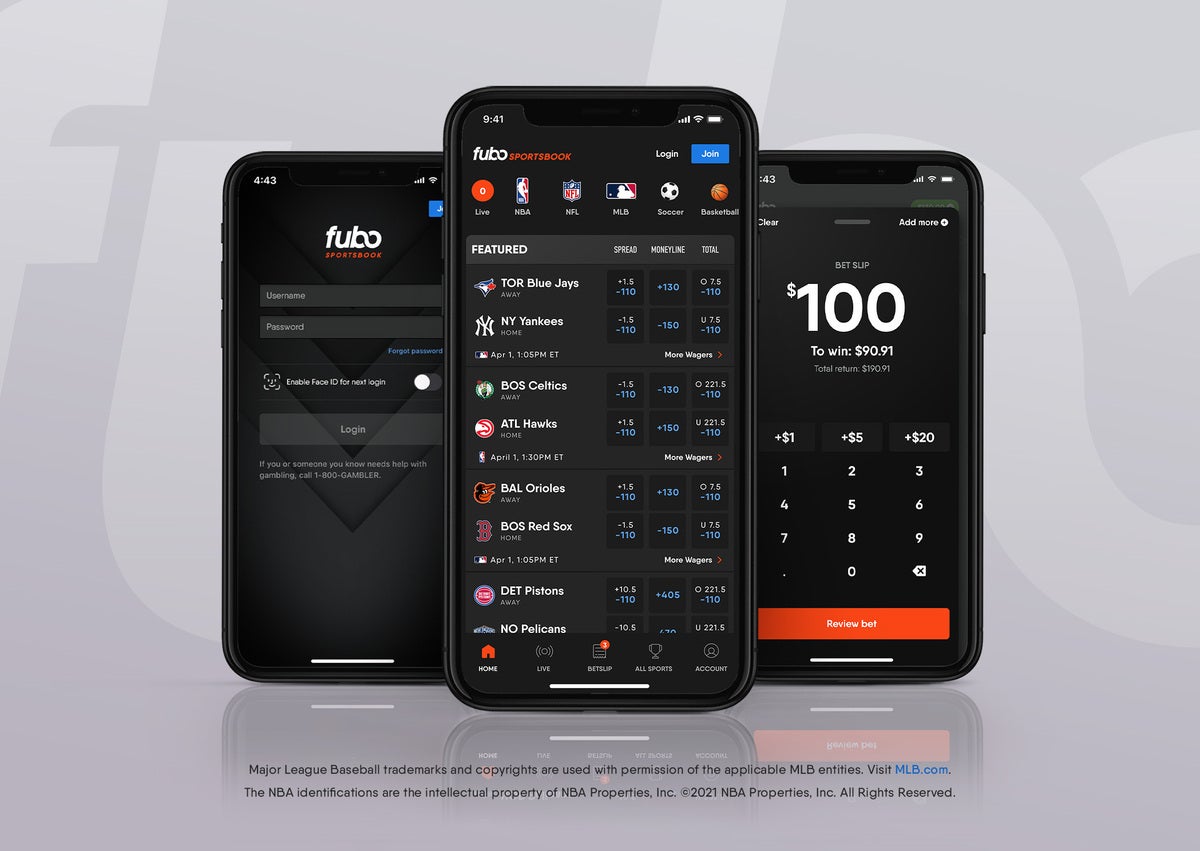

All of this might explain why TV providers have become so eager to get into the gambling business. This week, FuboTV announced plans to open a sportsbook in the fourth quarter of 2021, and Dish Network announced a deal with DraftKings to let customers place bets through their TVs, starting on Dish and eventually moving to Sling TV. Sinclair, the current owner of regional Fox Sports networks, also plans to support sports betting this year as a precursor to selling regional networks directly to consumers in 2022.

By letting people bet on the games they’re watching, these providers may have found a new audience to help pay for live sports. That could be good news if you’re hoping for cheaper ways to watch sports without cable—unless you’re a gambler yourself.

Betting in bits and pieces

Before you get too excited about this brave new world, keep in mind that it’s coming together piecemeal due to state laws around sports betting and online gambling.

According to the American Gaming Association, sports betting is only legal in half of U.S. states, five of which haven’t started operations yet, and each has its own complicated set of rules. Some state, for instance, require people to register a sportsbook account in person. Others restrict gambling operations to commercial casinos, including ones operated by Native American tribes.

Dish customers in certain states can now place bets through their TV boxes.

Services that combine live sports with gambling are therefore quite limited as to where they can operate. Dish’s new integration with DraftKings is only available in Colorado, Illinois, Indiana, Iowa, New Hampshire, New Jersey, and Virginia; approval is pending in West Virginia, Michigan, Tennessee, and Pennsylvania. FuboTV has only announced plans to operate in Iowa, Indiana, and New Jersey. Sinclair has formed a strategic partnership with the casino group Bally’s, but hasn’t revealed specific launch plans for its betting services.

While it’s certainly possible that other cash-strapped states will come around on sports betting—17 of them have introduced some sort of legislation to that effect—it’ll be a while until TV providers can make much money from the endeavor.

What it might mean for cord-cutters

Still, if these betting services move into more states, they could have a big impact on the cost of live sports.

For live TV services like Fubo TV, revenue from its sportsbook could help subsidize rising costs and fend off future price hikes. While sports and local broadcast channels themselves aren’t getting any cheaper, FuboTV or Dish might be more willing to eat the costs if it means keeping potential gamblers around.

FuboTV

FuboTVFuboTV wants to fuse live sports streaming and gambling.

Sports betting might also accelerate the unbundling of live sports from pay TV packages. Sinclair already sees gambling as a way to make a standalone sports streaming service more viable, and as other services including Peacock, ESPN+, and Paramount+ add more live sports to their lineups, they could turn to betting to avoid drastic across-the-board price hikes. (ESPN, incidentally, has started making inroads into the betting business as well.)

That’s not to say we should all feel great about the idea of gamblers subsidizing the cost of live sports. There’s obviously an air of exploitation to it, and the house advantage dictates that gambling will make live sports more expensive for those who partake.

But in the near term, it’s hard to see any alternative that keeps live sports from getting more expensive. Just last month, CNBC reported that the NFL wants TV networks to double their payments from TV networks for broadcasting rights. With or without virtual casinos, that money has to come from somewhere.

Sign up for Jared’s Cord Cutter Weekly newsletter to get this column and other cord-cutting news, insights, and deals delivered to your inbox.

[ad_2]

Source link