Warren Buffett’s Berkshire Hathaway trims 1% of its massive stake in Apple

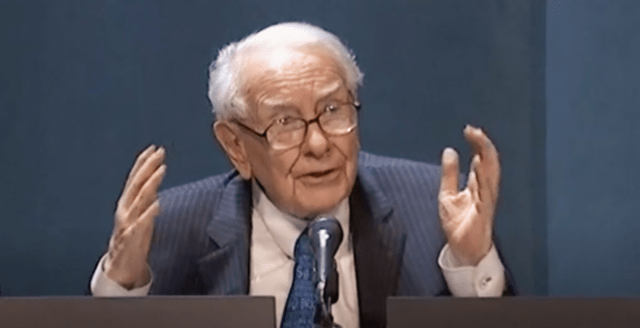

Warren Buffett at Berkshire Hathaway’s annual meeting of shareholders on May 8, 2023

Warren Buffett’s Berkshire Hathaway trimmed its flagship position in Apple in the fourth quarter. Berkshire sold about 1% of its Apple shares in the final three months of 2023, leaving it with a 5.9% stake in the iPhone maker worth about $167 billion.

Karen Langley for The Wall Street Journal:

Apple shares haven’t kept pace with some of its Big Tech peers in recent months. The iPhone-maker recently lost its crown as the U.S.’s most valuable company to Microsoft. It has faced a slew of challenges, including regulatory scrutiny of its App Store policies, declining sales in China and investor worries about its growth prospects. Several analysts have downgraded the stock.

Berkshire revealed the moves Wednesday afternoon in a filing with the Securities and Exchange Commission.

Followers of Berkshire are looking ahead to Buffett’s annual letter, which is expected to be released Feb. 24, along with the company’s annual report. It will be Buffett’s first letter to shareholders since his long-time partner, Charlie Munger, died Nov. 28.

MacDailyNews Take: Sounds like a small sale to cover taxes.

Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post Warren Buffett’s Berkshire Hathaway trims 1% of its massive stake in Apple appeared first on MacDailyNews.