Indian stocks plunge as Modi’s likely weaker win causes policy worries

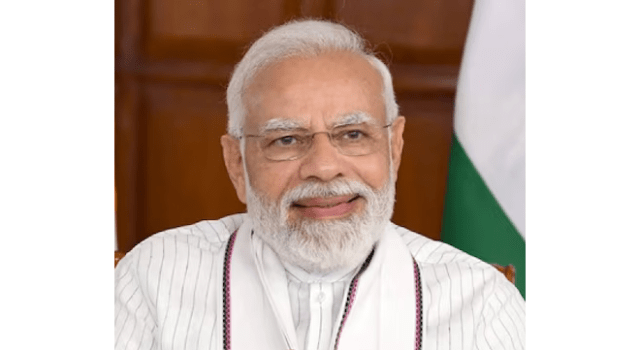

Indian Prime Minister Narendra Modi

As vote counting trends in the general election suggested Indian Prime Minister Narendra Modi’s alliance was unlikely to win the overwhelming majority predicted by exit polls, Indian stocks suffered their worst intraday fall since March 2020 on Tuesday.

Bharath Rajeswaran and Ankur Banerjee for Reuters:

With over half the votes counted, Modi’s own Bharatiya Janata Party (BJP) looked unlikely to secure a majority on its own in the 543-member lower house of parliament and would need allies in the National Democratic Alliance (NDA) to form the government.

That could lead to some uncertainty over economic policies, such as the push for investment-led growth, which has been the cornerstone of the Modi government’s rule. The Indian economy grew 8.2% in the financial year ended March 2024.

“The key question is whether BJP can retain single-party majority. If not, then would its coalition be able to deliver economic development, particularly infrastructure?” said Ken Peng, head of investment strategy, Asia, at Citi Global Wealth.

“In our view, the important thing is that the NDA returns to form the next government, which represents policy continuity,” said Mike Sell, head of global emerging market equities at Alquity in London.

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

MacDailyNews Take: Will affect Apple, and its suppliers, in India in some way, but it’s too early to tell in which way.

Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post Indian stocks plunge as Modi’s likely weaker win causes policy worries appeared first on MacDailyNews.