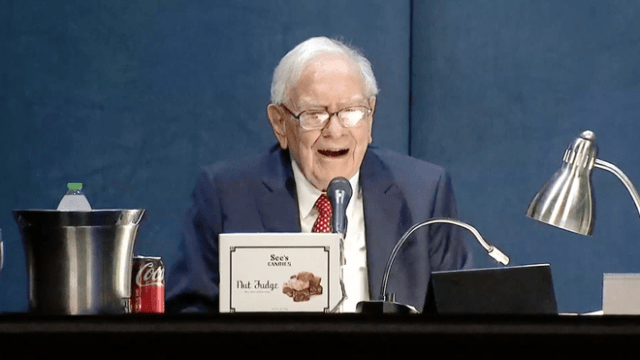

Warren Buffett’s Berkshire Hathaway might be finished selling Apple stock

Warren Buffett’s Berkshire Hathaway seems to be done with selling its prodigious Apple stake after having reduced its Apple stock holdings by nearly 50% in the second quarter.

The company’s 13-F report, released late Wednesday afternoon, offers a hint that Berkshire may have completed its sales.

The 13-F showed that Berkshire owned exactly 400 million shares of the iPhone maker on June 30 after cutting the stake by some 389 million shares in the second quarter. The 10-Q information on the Apple stake was less precise on the exact size of the stake.

Some Berkshire watchers think Berkshire CEO Warren Buffett, who oversees the $300 billion equity portfolio, likes round numbers and that the 400 million figure is significant for that reason. It’s notable that Berkshire also owns exactly 400 million shares of Coca-Cola, which the company has held at that level for more than 25 years.

“It’s just too much of a coincidence to end the quarter at exactly 400,000,000 shares,” one Berkshire watcher told Barron’s. He thinks Buffett may have told his trader at Berkshire’s Omaha headquarters to stop selling Apple at 400 million.

MacDailyNews Take: Two pieces of advice from Warren Buffett that we value highly:

• Diversification is a protection against ignorance.

• Be fearful when others are greedy. Be greedy when others are fearful.

Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

The post Warren Buffett’s Berkshire Hathaway might be finished selling Apple stock appeared first on MacDailyNews.